Read Also: Complete Guide To ETF Investing In SingaporeĪccording to its factsheet, companies within ARKK “rely on or benefit from” advancements in these 4 business sectors: This number is 26.0% higher than at the end of 2020. The ARK Innovation ETF (ARKK) is its flagship fund, with US$22.3 billion in assets under management (as of 31 March 2020). Israel Innovative Technology Fund (IZRL) – tracking the ARK Israeli Innovative Index.The 3D Printing ETF (PRNT) – tracking the Total 3D-Printing Index.ARK Space exploration and Innovation ETF (ARKX).

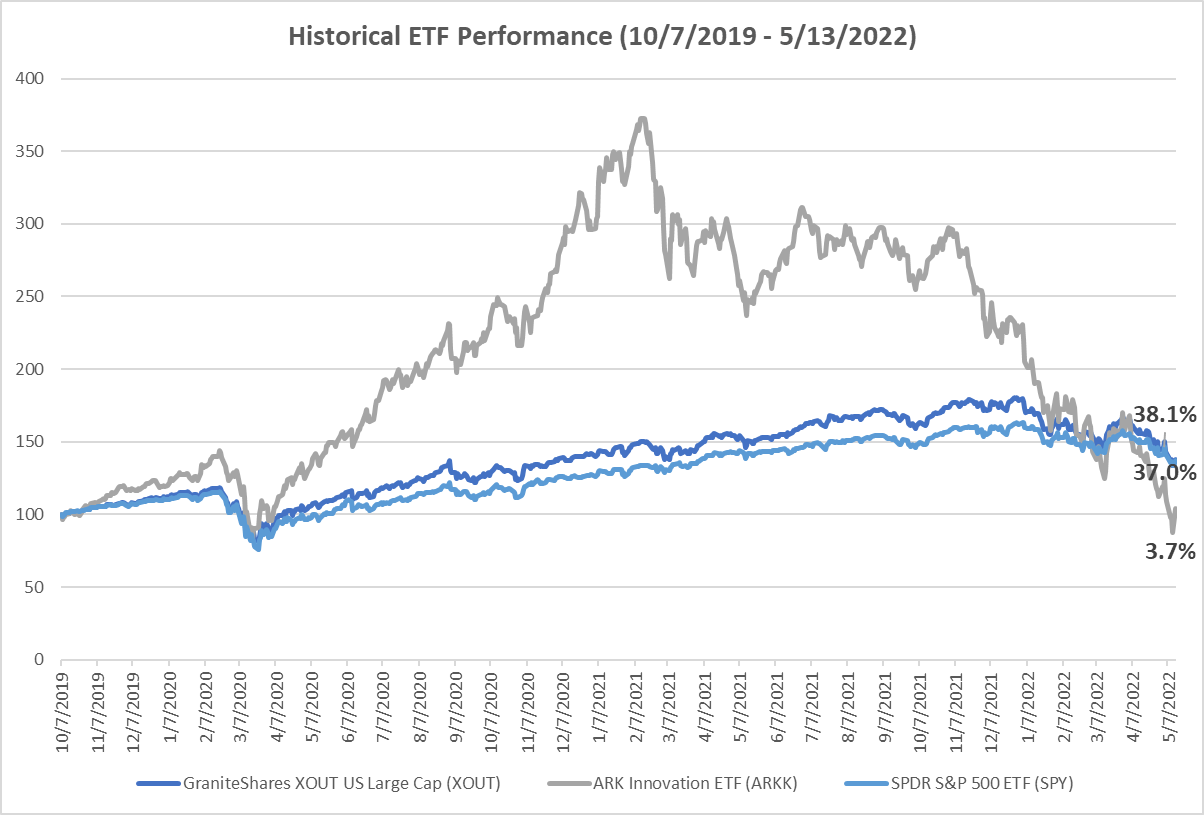

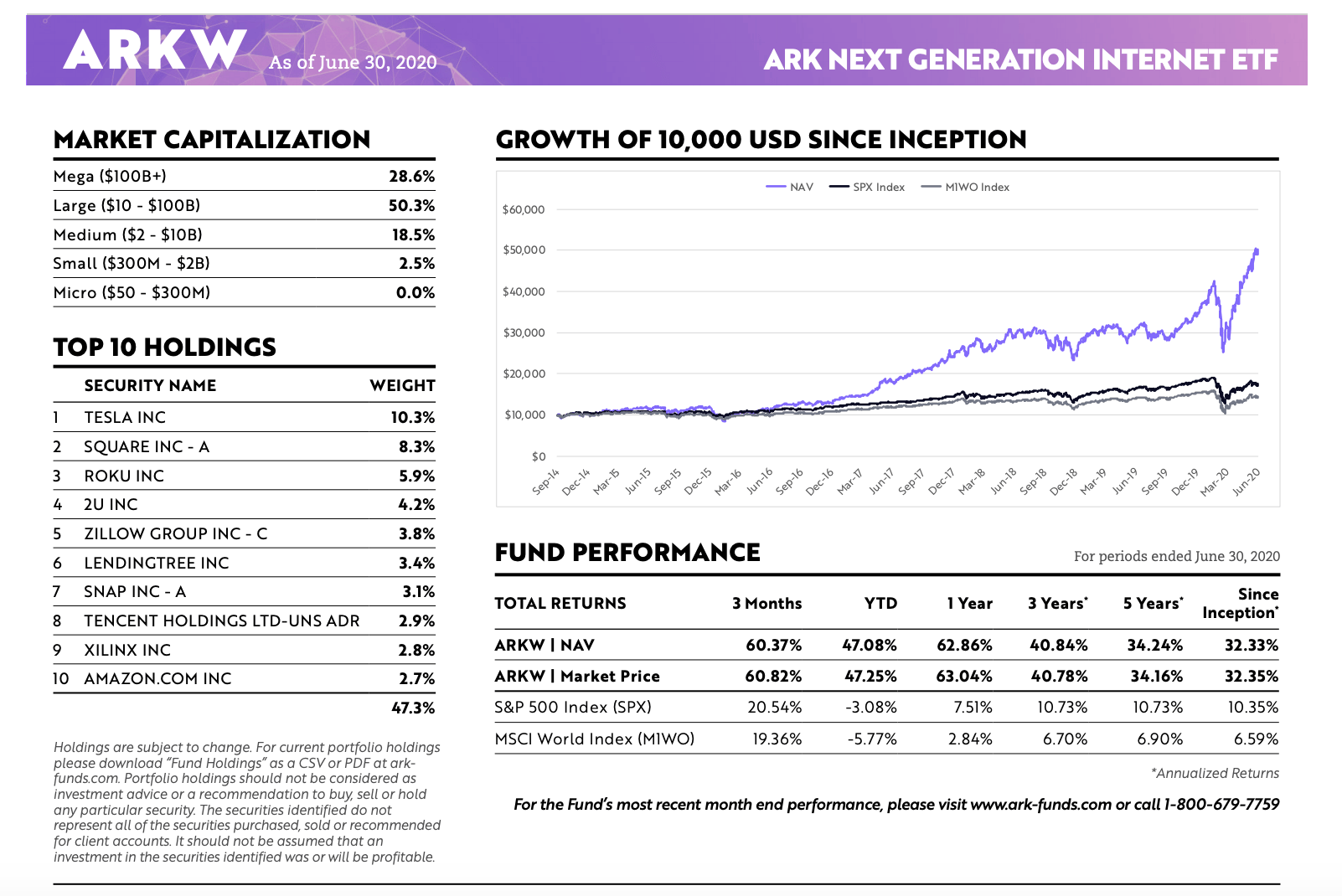

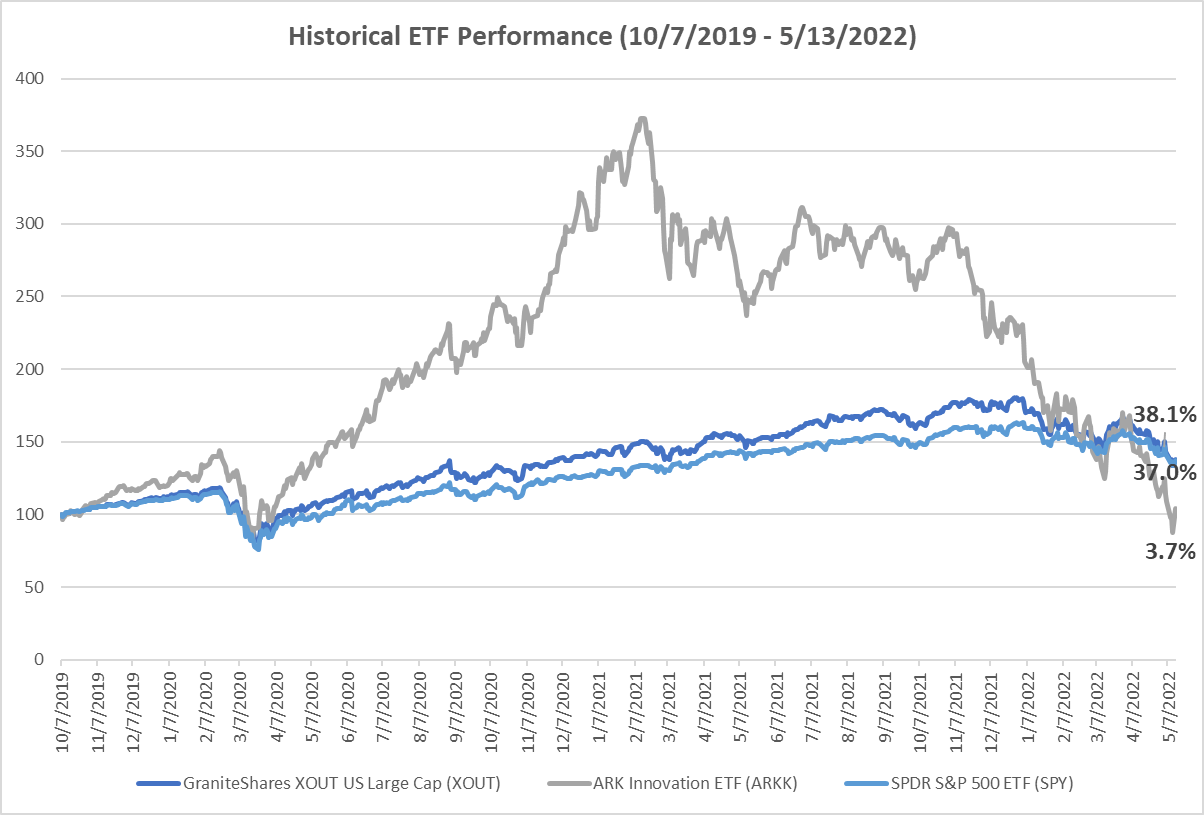

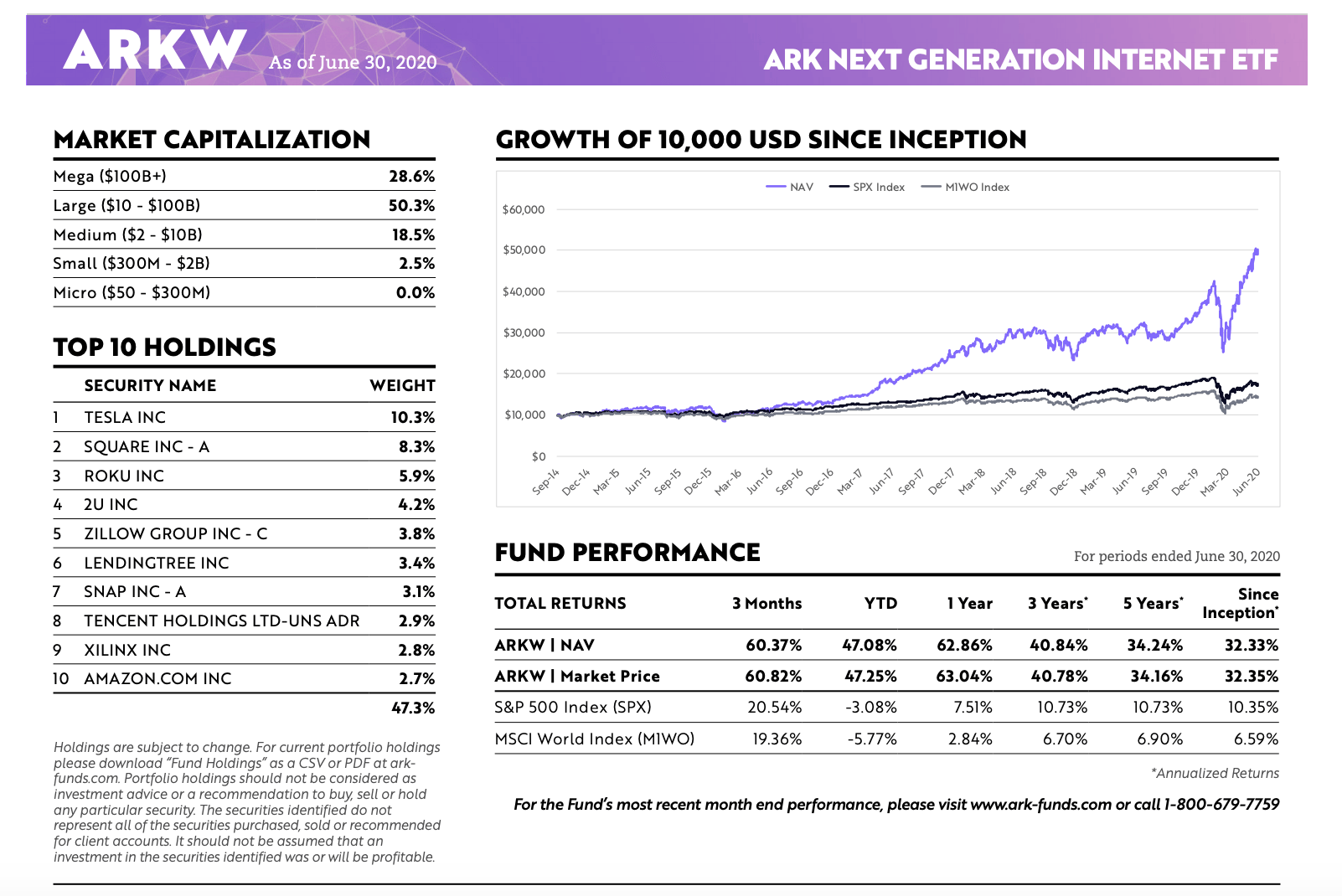

ARK Next Generation Internet ETF (ARKW). ARK Autonomous Technology & Robotics ETF (ARKQ). Read Also: Active Vs Passive ETF – Which Is Better To Invest In? The newest ARK ETF – ARK Space Exploration & Innovation ETF was incepted on 30 March 2021, and is understandably exposed to another field of disruptive technology. While most ETFs tend to be passively managed by replicating an index, there is a fraction of actively managed ETFs as well.Ħ of ARK’s 8 ETFs are actively managed ETFs (first 6 in list), while the other 2 ETFs track indexes that are heavily geared towards innovation (last 2 list). There are actually 8 ARK ETFs that we can invest in. ETFs managed by ARK have grown to over US$50 billion in assets under management (AUM), from about US$3.6 billion a year ago.Īlong with the rise in prominence of ARK ETFs, its founder, CEO and CIO Catherine Wood has also gained widespread recognition globally, if not already held in a cult status among investors. We strive to invest at the pace of innovation.”Īccording to a NASDAQ report in February 2021, ARK has seen a spike in money pouring into its ARK ETFs over the past year. Innovation is causing disruption and the risks associated with the traditional world order are rising. “ While traditional investors seek safety in benchmarks and passive strategies, ARK believes this behaviour is counterproductive. On its website, ARK describes its investment philosophy as: To-date, ARKK is trading 12.7% lower, and since its peak in mid-February 2021, it has declined 30.6%. Of course, another reason for its popularity among investors has been its monster returns in 2020 – with its flagship ARK Innovation Fund (ARKK) delivering over 152% in 2020. ARK ETFs are practically defined by the notion that they are investing in the most disruptive technologies globally. This is partly driven by the COVID-19 pandemic, which cast a spotlight on disruptive technology trends spearheading growth in the #NewNormal world we now live in. This article was originally published on 29 March 2021 and updated to reflect the latest information on ARK ETFs.ĪRK ETFs have been gaining huge interest globally, especially since 2020 and into 2021.

ARK Next Generation Internet ETF (ARKW). ARK Autonomous Technology & Robotics ETF (ARKQ). Read Also: Active Vs Passive ETF – Which Is Better To Invest In? The newest ARK ETF – ARK Space Exploration & Innovation ETF was incepted on 30 March 2021, and is understandably exposed to another field of disruptive technology. While most ETFs tend to be passively managed by replicating an index, there is a fraction of actively managed ETFs as well.Ħ of ARK’s 8 ETFs are actively managed ETFs (first 6 in list), while the other 2 ETFs track indexes that are heavily geared towards innovation (last 2 list). There are actually 8 ARK ETFs that we can invest in. ETFs managed by ARK have grown to over US$50 billion in assets under management (AUM), from about US$3.6 billion a year ago.Īlong with the rise in prominence of ARK ETFs, its founder, CEO and CIO Catherine Wood has also gained widespread recognition globally, if not already held in a cult status among investors. We strive to invest at the pace of innovation.”Īccording to a NASDAQ report in February 2021, ARK has seen a spike in money pouring into its ARK ETFs over the past year. Innovation is causing disruption and the risks associated with the traditional world order are rising. “ While traditional investors seek safety in benchmarks and passive strategies, ARK believes this behaviour is counterproductive. On its website, ARK describes its investment philosophy as: To-date, ARKK is trading 12.7% lower, and since its peak in mid-February 2021, it has declined 30.6%. Of course, another reason for its popularity among investors has been its monster returns in 2020 – with its flagship ARK Innovation Fund (ARKK) delivering over 152% in 2020. ARK ETFs are practically defined by the notion that they are investing in the most disruptive technologies globally. This is partly driven by the COVID-19 pandemic, which cast a spotlight on disruptive technology trends spearheading growth in the #NewNormal world we now live in. This article was originally published on 29 March 2021 and updated to reflect the latest information on ARK ETFs.ĪRK ETFs have been gaining huge interest globally, especially since 2020 and into 2021.

0 kommentar(er)

0 kommentar(er)